Each month there is a certain amount of money that will be used on different goods and services, like phone bills and food. Some of these expenses cannot be avoided, while others could be considered less necessary and therefore, avoided if need be.

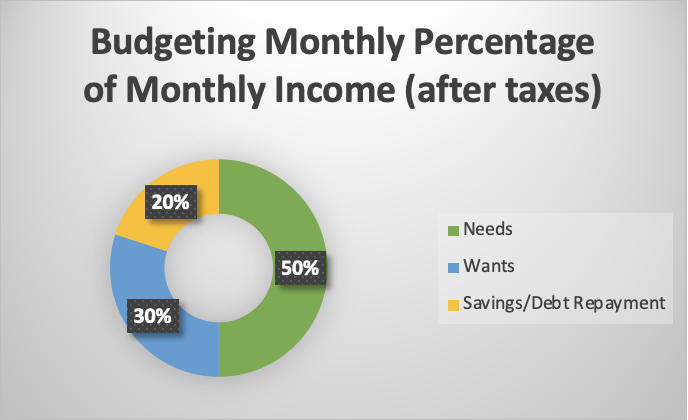

When you know how much your after-tax salary is per year, you can find out how much you will have monthly to live off of by dividing the after-tax income by 12, for each of the months. It is suggested by most budgeting tools to divide up your monthly income into three categories: needs, wants, and savings/debt repayment.

The 50-30-20 method is widely considered the best way to budget your monthly income. This method accounts for 50% of the monthly income to go to needs, 30% to go to wants, and 20% to go to savings and debt repayments.

A need is an expense that you absolutely must pay every month just to survive. These costs include:

A want is an expense that is not necessary to sustain life, but still is something that you'd like to pay for. These costs include:

Your savings is your sum of money that you have for future expenses, like a wedding, house and retirement. These are funds that you should try to only use when you need to, prior to being used for whatever goal you initially planned.

Debt repayment is a bit different than the loan repayments mentioned in the Expenses section of this page. Each month, if you have loans to pay off, there will be a minimum amount that you have to pay. If you choose to use some of the 20% category on paying more than the minimum requirement, then it falls under debt repayment, according to NerdWallet.

Depending on where you choose to live and work, your living costs will change. Some cities are more expensive than others, and there are many tools, like NerdWallet’s Cost of living calculator, that can calculate how much it would cost for you to live in a specific place.

Here are four popular cities for recent college graduates and their cost of living per month. Each of these figures take into consideration the average monthly costs from a range of sources and services.

| City | Cost of Living for One Person, One-Bed Apartment | Skyline |

|---|---|---|

| St. Louis, MO | $1,500-$2,300 |

|

| Chicago, IL | $1,600-$3,000 |

|

| Dallas, TX | $1,900-$2,800 |

|

| Charlotte, NC | $1,500-$2,800 |

|

Sources for cost of living information and 50-30-20 method: nerdwallet.com, apartmentlist.com, zumper.com, livingcost.org, numbeo.com, rentbottomline.com